capital gains tax proposal reddit

Operating budget proposal creates unsustainable spending relies on unnecessary unpopular capital gains income tax. Click to share on Reddit Opens in new window.

/GettyImages-1027486134-8d56cbe38fc441c4807b38ef6b542180.jpg)

What Makes Singapore A Tax Haven

Push back on Charlie Bakers plan to slash short-term capital gains taxes double.

. Click to share on Reddit Opens in new window. Capital gains is the difference between what you paid for the home and what you sold it for. No documentation for capital gains tax.

Equity markets took a quick downturn after the announcement assuming people will be locking in cap gains before the tax law. Short-term capital gains are gains you make from selling assets that you hold for one year or less. Corporate tax rate would rise to 265 from 21.

For instance single filers who make between 40401 and 445850 will pay a 15 tax on long-term capital gains in 2021. Currently taxes on gains fall into 2 classifications. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

News discussion policy and law relating to any tax - US. And International Federal State or local. The 1 trillion bipartisan infrastructure package and the 35.

Long-term capital gains are gains on assets you hold for more than one year. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. - It wont affect most of the wealthy in retirement.

The IRS is experiencing significant and extended delays in processing - everything. Do we need to pay any CA state capital gains tax on these gains made in GA. Short Term and Long Term with Short Term being taxed much higher and Long Term taxed within your applicable tax bracket.

Reddit iOS Reddit Android Reddit Premium About Reddit Advertise Blog Careers Press. Most people dont purposefully generate 1M of capital gains and dividend income in a given year. The conveyancer does not keep the records anymore as it was older than 7 years.

Bloomberg -- President Joe Biden will propose almost doubling the capital gains tax rate for wealthy individuals to 396 which coupled with an existing surtax on investment income means that federal tax rates for investors could be as high as 434 according to people familiar with the proposal. Here are the long-term capital gains tax rates for 2021. Some individual filers may even pay no capital gains tax if their total taxable income falls below a certain threshold.

Capital Gains Tax PA to Texas. Currently the highest long-term capital gains and dividend rate affect single filers with annual income above 441450 and joint filers with income above 496600. I was living in Pennsylvania until May 31 2021 but moved to Texas and June 1st and sold everything that summer.

Basically i am selling a property but do not know the initial purhase costs because it was over 10 years ago. How much you owe on the mortgage is irrelevant. The increase in long-term capital gains and the highest dividend rate is lower than that proposed by President Joe Biden who argued for a 396 rate for high earners.

Reform Capital Gains Tax. That means ALL capital gains generated by these individuals will automatically fall in the high tier. Understanding Capital Gains and the Biden Tax Plan.

My family moved from a lower tax state GA to CA last year in July and we also bought a house in August somehow. Bidens proposal would nearly double the top rate which is the impact of the personal tax rate hike to 396. Theyre taxed at lower rates than short-term capital gains.

According to multiple reports Biden will propose raising the capital gains tax rate to 396 percent for those earning more than 1 million. That means you pay the same tax rates you pay on federal income tax. Dont post questions related to that here please.

Combining Bidens proposed capital gains tax with the existing estate tax law which says that if you die with over 117 million in assets that amount is taxed once at a 40 rate some wealthy. Reddits home for tax geeks and taxpayers. Charlie Bakers 700M tax relief plan for Massachusetts gains steam.

Currently the long-term capital gains tax rate is 15 or 20 depending on the income bracket. Bidens Tax Plan on Capital Gains. Early last week the Conservatives called on the Trudeau Liberals to stop funding home tax studies and reject a proposal before cabinet to tax the capital gains on homes.

Combined with the existing surtax on investment income. If you paid 130K and sold for 200K for example your gain is 70K regardless of how much is on the mortgage. When filling out Turbotax it says I have to pay 2k in state tax to PA for the cap gains but there is a box that says.

Depending on your regular income tax. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. A proposed 582 billion operating budget proposal that passed the House today increases spending by nearly 13 percent over the current biennial budget and relies on an income tax on capital gains which is likely unconstitutional.

The perspective is probably for most people passive income from capital gains does not require any real effort so it is unfair to the working masses that it. In 2021 I made a considerable amount 80k trading stock and bitcoin. Before we moved in March - ie were still residents of GA - we sold some investments as long term capital gains.

Theyre taxed like regular income. The wealthiest Americans single filers earning 445851 or more are subject to a 20 long-term capital gains tax. With the recent leak of Bidens tax plan to increase capital gains rates to around 40 for the wealthy over 1mm income how do you think this will affect crypto markets if at all.

- It might affect long term capital gains for big windfalls - such as companies being sold. Capital-gains taxes would also go up. Cut the tax rate on.

This proposed change says all gains long and short will be taxed at the higer rate for anyone who makes over 1Million income.

Here S How Biden S Tax Plan Would Affect Each U S State

/cdn.vox-cdn.com/uploads/chorus_image/image/62786093/1076675010.jpg.0.jpg)

Alexandria Ocasio Cortez S 70 Percent Top Tax Rate Makes Sense Vox

What Does The 2021 Biden Tax Plan Mean For Doctors A Deep Dive By The White Coat Investor Youtube

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Vortecs Report Storage Coins Rev Up Gains As Markets Pro Rides The Green Wave Cryptocurrency How To Memorize Things Blockchain

Trojan Horse Cap Gains Proposal Likely In 2021 Lens Seattle Financial Statement Public Company Government

News Of The Day Top 5 Exchange Hold 1 96 Million Btc Supply Hold On New Day Cryptocurrency News

News Of The Day Google Allows Crypto Ads Under Its Updated Financial Policy Video In 2021 Financial Cryptocurrency News Ads

How Do You Feel About Your Country S Tax Rates R Askeurope

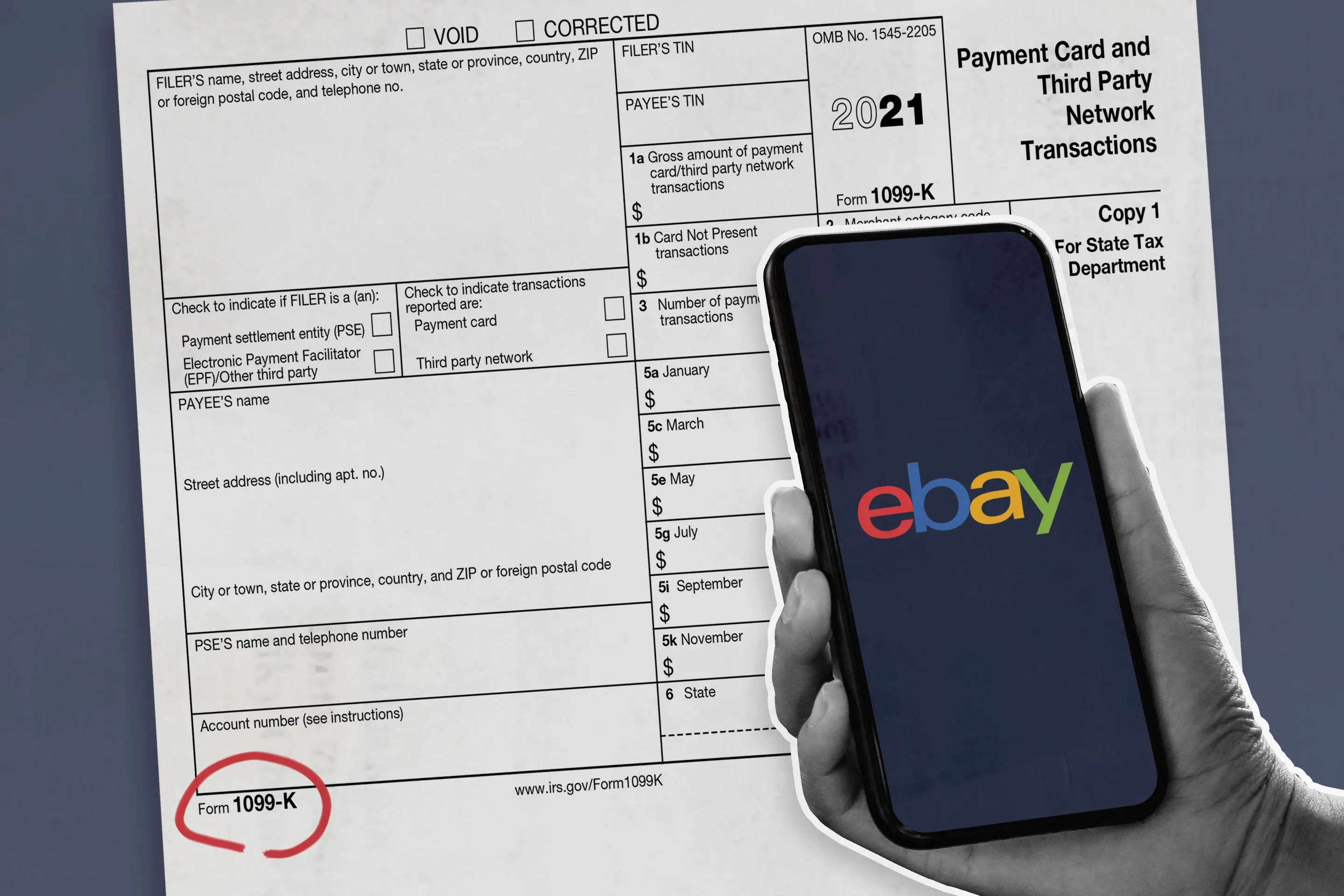

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

Here S How Biden S Tax Plan Would Affect Each U S State

Stocks Dive On Report Of Biden S Capital Gains Tax Proposal

Manchin Signals Support For Human Infrastructure Measure Nudging Up Corporate And Capital Gains Tax

/cdn.vox-cdn.com/uploads/chorus_asset/file/10652251/GettyImages-507814528.0.0.jpg)

Turbotax Don T File Your Taxes With It Vox

Paul Lepage Renews Push To Eliminate Maine S Income Tax At 2022 Campaign Kickoff